What does it take to create a company that lasts over 120 years? According to the Kaspar Companies, there are three core values that have contributed to its identity and longevity since its foundation: stewardship, versatility, and family.

~

Jason Kaspar, CEO and fifth-generation owner of the Shiner, Texas-based parent company, reveals that it has reinvented itself several times in the course of its history, and is in fact currently going through a period of reinvention right now.

“We’re a very young-at-heart company,” he says. “If you go back to 1898, when my great-great grandfather started this company, there was no such thing as a car. If he were going to make a sales call, he would have to hook up his horses to his wagon and travel. From there, the car gets invented, there was the Depression, two World Wars, somebody went to the moon, the home computer was invented, the cell phone, and the internet. All of those things are massive disruptors to a business. A lot of companies don’t survive because they are not responsive. With our company as a whole and our subsidiaries, we are in a lot of different industries today because we saw an opportunity and were willing to be versatile, to find a solution with a different answer than we would have had 80, or even 10 years ago.”

Over the decades, Kaspar Companies has expanded into several markets. Its nine subsidiaries include Kaspar Manufacturing, Texas Precious Metals, Ranch Hand Truck Accessories, BEDROCK Truck Beds, Truckfitters, Silverback Homes, Horizon Firearms, iota Outdoors, and Espresso Marketing.

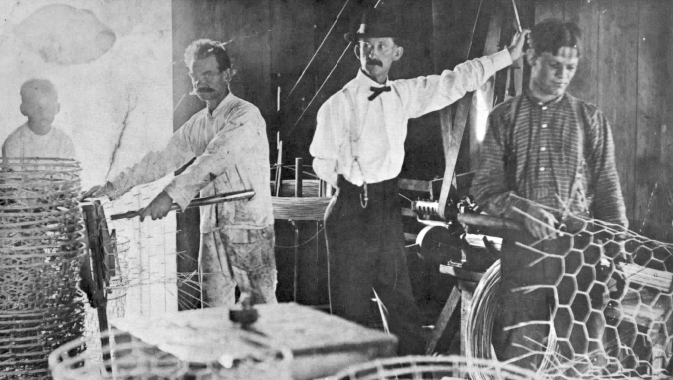

Impressively, the 121-year-old family of companies started its journey in the late 1800s with just a single wire basket, which Founder August Kaspar fashioned from an old smooth wire fence after barbed-wire was invented and farmers began discarding their old fencing material. He sold baskets as a sole proprietor until his son joined the family business and eventually designed new machines for the production of Kaspar-made goods. The Kaspar product line grew to include some of the first grocery store shopping carts and eventually newspaper racks. The company has undergone many transformations since, adapting to changing market needs.

“One of the things that impresses me about Kaspar Companies is that it has always had the willingness to take smart risks,” says Gerald Tempton, Chief Administrative Officer. “I emphasize smart because it is not just risk for risk’s sake, but evaluating different opportunities and having a willingness to give it a try, which is why you see such diversity in the subsidiaries that we have that have been very successful. The opposite is also true, which is knowing when to discontinue doing business. We look to the future and the horizon.”

Kaspar Companies’ early newspaper business exemplifies this quality. As the former leading maker of coin-operated newspaper racks, there was a time where 90 percent or more of racks countrywide were made by Kaspar Companies. When physical newspapers began to decline, Kaspar made a calculated decision to seek out new opportunities. Not long after, Kaspar Companies purchased Ranch Hand, reset the company, and relaunched it.

“We are no longer in the newspaper business, but it was quite a good business,” Tempton continues. “Taking the smart risk to either go forward with something new or discontinue something where efficacy is starting to wane is something that Kaspar Companies has been very deliberate and successful with, and this has very much added to its longevity.”

The Kaspar Companies’ reach into sundry sectors may seem arbitrary from an outsider’s point of view, but its progression into these diverse fields was a natural process stemming from the company’s attitude of self-reliance. “Through the years, if we needed electroplating for our business we figured out how to do electroplating. If we needed a die and tool machine shop, we figured out how to do it ourselves,” describes Douglas Kaspar, Board Member and fourth-generation owner.

A more recent example of that is Texas Precious Metals, a Kaspar Companies subsidiary that Jason Kaspar co-founded in 2011. Jason Kaspar worked in investment firms in New York and Dallas before settling down in Shiner, Texas.

“My background is all business, Wall Street,” he says. “Coming out of [the recession of] 2008 and 2009, I felt like the risk profile had changed, where the government has socialized risk. I started getting really interested in gold and silver as an asset class. We don’t consider gold and silver as an investment; we consider it as a different currency form.”

Traditionally, the biggest problem with owning gold and silver was its negative carry. Owning precious metals involves paying storage costs and perhaps even insurance, giving owners a negative ROI. “I started to think a lot about how you could use gold and silver as a positive asset class,” Jason recalls.

Channeling his finance background, Jason Kaspar envisioned a trading desk for gold and silver that functioned similarly to those for stocks and bonds, buying the metals in bulk quantities and selling for small gains to retail investors who are just looking for a few ounces of gold.

“We started buying government-minted bullion from the United States Mint, the Canadian Mint, and the Australian Mint. We started a trading desk, and selling across the United States. We quickly became one of the largest bullion dealers in the United States,” says Jason.

He describes the business model as similar to any other type of currency exchange. “If you fly to London and want to have dinner at the airport, you would go to a kiosk and trade currency for British pounds. Let’s say you have 20 pounds left over and are flying out the next day. You go to the airport and change it back to dollars. That’s all we’re doing for investors, acting as that middle man, taking very small margins. For us it ends up changing that negative carry to a positive return on what has historically been considered a ‘dead asset.’”

Today, Texas Precious Metals is one of the largest precious metals companies in the United States.

Another even more recent example of Kaspar Companies’ success is BEDROCK, which was started about two and a half years ago and had its first profitable month in a very short amount of time. BEDROCK had north of $4 million in revenue in 2018. This year, it is forecasted to grow by 100 percent, about $8 million in revenue. Ranch Hand also had record sales in 2018 and continues to grow and expand geographically. Horizon Firearms, another subsidiary, offers distinctive firearms assembled from the finest components to provide “excellence in workmanship, aim, style, comfort, and use.” Meanwhile, Espresso, Kaspar Companies’ marketing and advertising wing, is another new addition to this family of companies that has won five ADDY® Awards.

Kaspar Manufacturing, meanwhile, has been a part of Kaspar Companies since its creation in 1898, and maintains a range of manufacturing capabilities including engineering, wire, sheet metal, machining and finishing.

The successes of Kaspar Companies subsidiaries can be linked to a growing movement within the organization to encourage efficiency in its business structure. Jason Kaspar is now in the process of leading Kaspar Companies in its lean initiative.

“Jason has studied the Danaher model of lean, which has its foundations in Japan. It discusses how to be more efficient, how to eliminate waste, how to teach people to do more – and do better – with the tools that they have, and then redeploy those people in more significant roles,” Tempton remarks.

The Danaher Business System, or DBS, for lean manufacturing drives the Danaher Corporation (NYSE:DHR) through a never-ending cycle of change and improvement.

“It’s a lot less about what people might think that lean is, which is a way to just reduce overhead. On the contrary, that is not what has been happening. We’ve been redeveloping people in ways that propel the company further. I consider this such a tremendous success because this is an initiative that several have tried. Most give up after a very short period of time. And we are seeing significant advancement across our subsidiaries,” Tempton tells us.

Jason Kaspar believes that lean manufacturing is a mindset even more than a series of actions. It involves thinking about the company in a new way that empowers the workers as part of an inverted pyramid model. Kaspar Companies subsidiaries have started lean daily management boards, or LDM boards, that measure five components: safety, quality, delivery, productivity, and cost. The LDM boards can be referred to during meetings or the beginnings of shifts so that workers on the floor can see what was successful the day before and what action items can be done to improve productivity the following day.

The benefits of adopting lean manufacturing principles are long-term, and will allow Kaspar Companies to continue competing on larger scales, to continue to weather economic changes, and enhance problem solving and strategizing skills. Moreover, lean manufacturing isn’t only about versatility. Being able to perform better with the assets you possess is part of the Kaspar core value of stewardship.

“Stewardship is multifaceted. It means making good investments for the company, making sure that we’re around years from now by making good decisions, but it also means giving back to the community,” Jason points out.

Kaspar Companies is a generous donor to many local charitable causes, including high school and youth programs. Kaspar Companies also organizes company scholarships for the children of employees, as the business believes that young people are the fabric of the rural town of Shiner (population 2,000).

An additional aspect of living in small-town Texas is that some of the communities, including Shiner, have volunteer fire departments that depend on donations to support the equipment and vehicles that they need to keep residents safe. The Kaspar family is proud to be one of the larger supporters of Shiner’s volunteer fire department.

Kaspar Companies isn’t sure exactly what the future will hold, but is now focusing on its latest phase of reinvention and keeping an eye on what else may come. “We’re very focused on what we have, and the idea of better before bigger,” Jason states.

Kaspar Companies is now in nine industries, and Jason Kaspar can foresee another acquisition in a complementary industry on the horizon, but no dates are set in stone. His ongoing goal for the organization is that it is seen as not only a company with incredible longevity, but as a business and employer that others can look to as a positive example.

“There’s only so much that you can plan, because we don’t really know what the future holds,” adds Douglas Kaspar. “A lot of it, through our history, is just managing our business in such a way so that we are attuned to opportunities as they arise. We recognize them and are able to respond to them. And secondly, that we are in a position, financially, to be able to pursue those opportunities.”

“What we’re doing with lean is helping to equip people to respond well to change. Things happen faster in today’s world, and the ability to develop internal agility is key. Part of what we do in helping people to develop what we call ‘lean eyes’ is also equipping them to handle change better, so that we’re ready to be responsive at the moment we decide it’s right to get into the inquisitive mode,” Tempton concludes.